A recent report by the Better Than Cash Alliance reveals that digital payments could add around $25 billion to Pakistan’s GDP and create 4 million new jobs. To make this happen, fintech companies must take the lead, similar to what has occurred in other emerging markets. One Karachi-based fintech company, Swich, is making significant strides in this area.

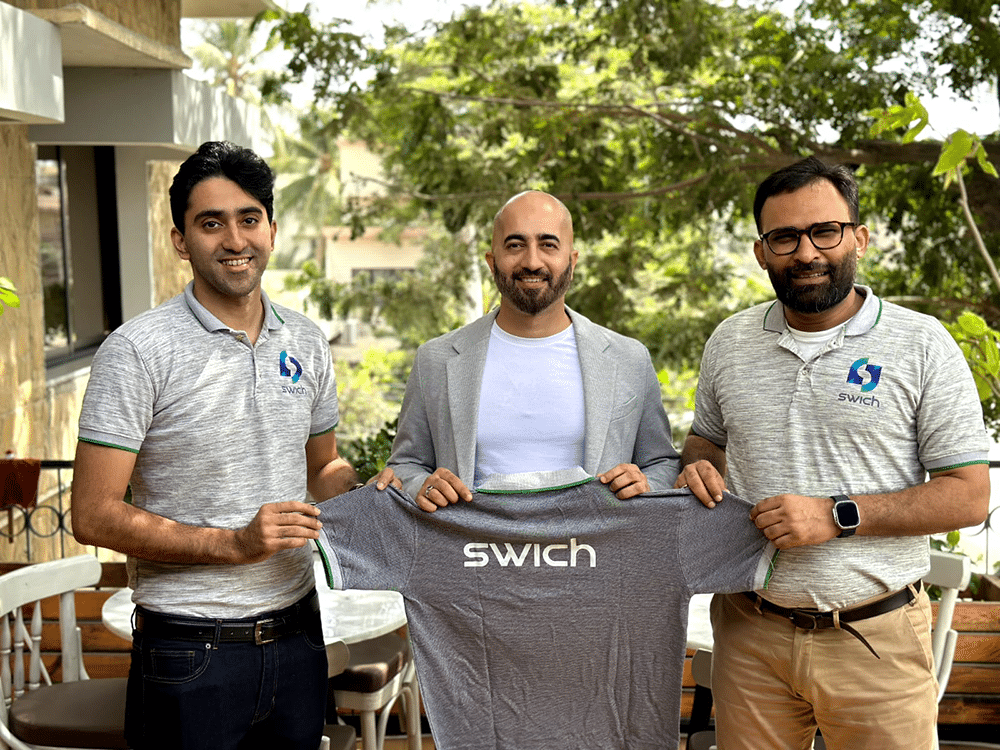

In just a few months, Swich has processed nearly PKR 6 billion in transactions, according to their website. The company is also strengthening its leadership team to support its ambitious growth plans. Muhammad Raza, formerly the head of Enterprise Business at Paymob, has recently joined Swich as a founding member and Chief Growth Officer. In his announcement, he expressed his enthusiasm for leading Swich’s expansion efforts both within Pakistan and internationally.

Raza believes that Swich possesses the right tools and leadership to make digital payments more accessible to everyone. His involvement highlights the increasing recognition of the potential in the payments sector in Pakistan.

As more companies enter this competitive space, including Payfast, Paymob, AbhiPay, and Keenu, the future of digital payments in Pakistan looks promising. With firms like Swich aiming for global reach, the country seems poised for a digital payments revolution. The shift towards digital payments is not just a trend; it’s an opportunity that could redefine Pakistan’s economic landscape.