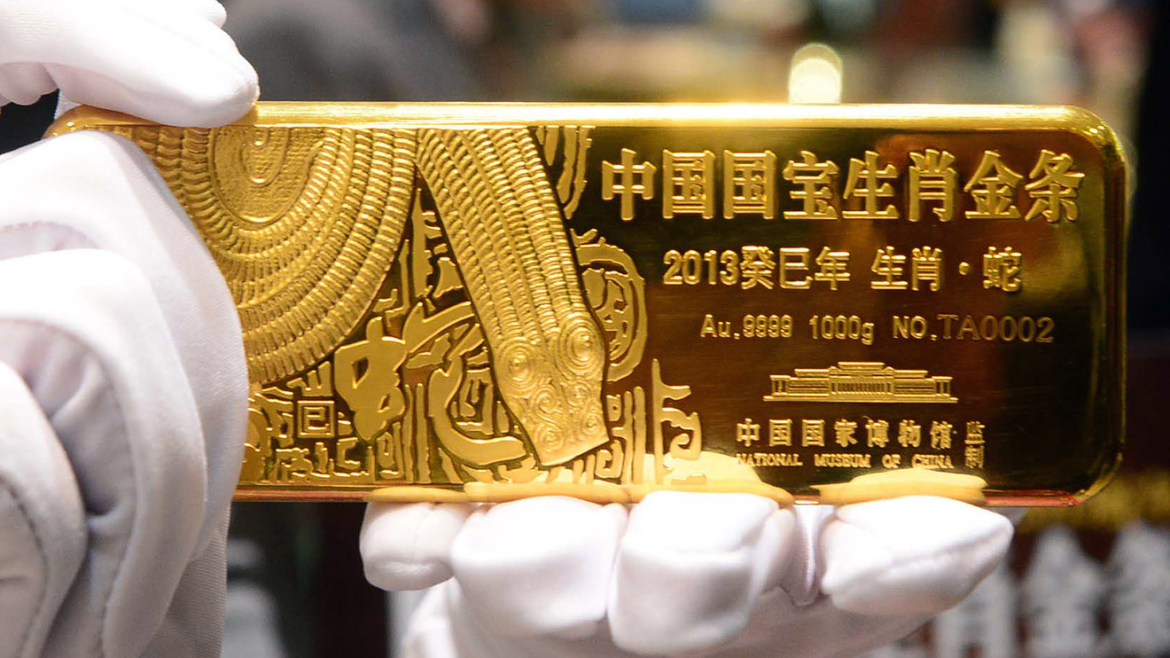

China’s gold reserves have crossed a major milestone, now exceeding 74 million ounces with an estimated value of more than $367 billion. The rise highlights Beijing’s growing role in the global gold market and reflects a long-term strategy to strengthen national financial reserves.

Over the past few years, China has steadily increased its gold holdings as part of a broader effort to diversify its reserves. Gold is widely seen as a safe asset during periods of global uncertainty, currency fluctuations, and economic pressure. By expanding its gold reserves, China aims to reduce reliance on foreign currencies and protect its economy against external risks.

Analysts say this move also supports China’s ambition to increase its influence in global finance and resource management. As one of the world’s largest economies, China’s actions in the gold market can affect prices, investor confidence, and international trade patterns. Central banks around the world closely watch China’s reserve strategy, as it often signals broader shifts in global financial trends.

Gold accumulation is also linked to long-term economic stability. Strong reserves help countries manage inflation, balance trade pressures, and respond to financial shocks. For China, this strategy aligns with efforts to safeguard its economic growth while navigating changing global conditions.

China remains one of the world’s leading gold producers, which further strengthens its position in the market. Domestic production, combined with steady purchases, allows the country to build reserves without heavy dependence on imports.

With gold prices remaining strong, China’s growing reserves underline its focus on security, stability, and long-term economic planning in an uncertain global environment.